Add a Chain to Your 3D Jewelry Design: Now Available in 6 Premium Finishes

We believe in customizing beyond the design for your jewelry. That’s why we now offer premium chains that you can order directly with your 3D model. This makes it easier…

Turn your 3D designs into reality with lost wax casting — powered by Castimize.

New to casting? Learn how lost wax casting works or watch our process video.

At our core, we are driven by a passion to bring designs to life. With nearly a decade of expertise in lost wax casting techniques, we constantly push boundaries and expand our knowledge to realize even the most intricate and complex creations.

From fine jewelry to custom parts, Castimize enables exceptional design. Our strong industry partnerships and proven track record of delivering tailored solutions empower us to turn your vision into reality.

Need something extra? Upon request, we also provide:

For custom pricing on repeat production or finishes beyond our current offerings, including custom metal design services and consultations, please contact us directly.

We work with high-quality materials, responsibly & sustainably manufactured by our network as approved by the Responsible Jewellery Council (RJC). The materials are highlighted on our Materials page, and include Bronze, Copper, Silver, Gold, Brass & Plated Brasses. Depending on your design and preferences, we offer the best options to bring your vision to life.

You can easily upload your 3D model directly on our platform. We support a variety of file formats, and once uploaded and paid for, we’ll automatically process your design for production.

Once your design is uploaded, our system instantly calculates the production cost and estimated delivery time based on material choice, complexity, and quantity. You will receive all the details before confirming your order. Prices and delivery time may vary over time, please see our Terms & Conditions for more details.

We collaborate with trusted suppliers and casting experts from the USA, Europe, Canada and India, ensuring top-tier craftsmanship for every project.

We take care of the entire logistics process. Once your order is complete, it is securely packaged and shipped directly to your chosen address.

We use UPS for shipping, the applied service would be UPS Standard or UPS Express Saver, depending on your location. Please note that our shipments are sent under Delivery Duty Unpaid (DDU) terms, meaning any import duties or taxes will need to be paid by you upon delivery.

For optimal results with lost wax casting, we recommend a minimum wall thickness of 0.8mm to ensure structural integrity and proper casting. Typically, only one part can be cast per mold, though exceptions for two parts may be possible depending on the model’s complexity. The process captures fine details as small as 0.4mm.

In terms of accuracy, deviations can vary based on the dimension, as tolerances are directional. For a polished finish, typical deviations are around 2.5%, with material removal ranging from 0.30-0.45mm. For a natural finish, deviations are closer to 1.5%, with 0.20-0.30mm of material removal.

For specific components such as ring diameters, our skilled craftsmanship ensures a high level of precision, often closely matching the original design file.

Yes, we offer chains and clippings upon request. You can reach out to us at [email protected].

Starting in Q1 2025, we will introduce a feature on our webshop that allows you to order these items directly.

Yes, we will securely store your files after purchase to create a personal library for your convenience. However, we do not claim any intellectual property (IP) rights or ownership over your files. The files remain fully your property. We store them solely to provide you with easy access for future use. You are free to request the deletion of your stored files at any time

As a Netherlands-based business, VAT (Value Added Tax) is applied to all orders shipped within the EU. The VAT rate depends on the destination country and is calculated based on local VAT rates, in compliance with EU VAT regulations.

If you are a registered business within the EU (outside of the Netherlands) and provide a valid VAT number during checkout, no VAT will be charged, as the reverse charge mechanism will apply. However, Dutch businesses must still pay VAT, even with a valid VAT number.

For orders shipped outside the EU, VAT will not be applied at checkout. However, please be aware that you may be responsible for paying import duties, taxes, or customs fees upon delivery, depending on your country’s regulations. We recommend checking with your local customs office for more details on these charges.

The need to pay customs duties or taxes on your order depends on the value of your order and the customs regulations of your country. For international orders, we operate under Delivery Duty Unpaid (DDU) terms. This means that any import duties, taxes, or customs fees are determined by your local customs authorities and may apply if your order exceeds the duty-free threshold in your country. If applicable, these charges will be your responsibility upon delivery. We strongly advise checking with your local customs office to understand the applicable thresholds and fees for your specific location.

We believe in customizing beyond the design for your jewelry. That’s why we now offer premium chains that you can order directly with your 3D model. This makes it easier…

Have you ever dreamed of creating your own jewelry — a ring, pendant, or charm — without needing years of design experience? With Tripo AI and Castimize, it’s now possible.…

Creators and jewelers on Etsy can now offer high-quality custom cast metal products more easily than ever. Using Castimize’s new Etsy integration, sellers can connect their shop directly to the…

Jewelry isn’t just about looks, it’s about lasting craftsmanship. At Castimize, we offer lost wax casting services in a wide range of premium metals, from affordable brass and elegant silver to…

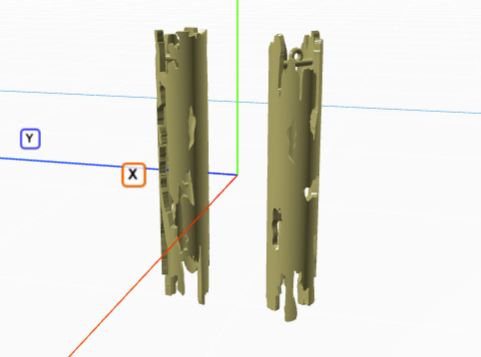

In our last post on generative AI, we explored the potential—and current limitations—of generative AI in 3D design, with tools like Rodin and Meshy. Some AI-generated models passed our casting…

Today, we’re celebrating a major moment on our journey: over 1,000 production orders are fulfilled through our platform. From day one, our mission has been clear: to make custom lost…

Jewelry in 2025 is all about bold statements, personal expression, and a touch of nostalgia. Whether you’re a jewelry enthusiast or a designer looking for inspiration, the trends this year…

Generative AI will play a major role in the future of 3D design. New tools like Rodin, Meshy, Instant Mesh, Maker World and Charmed AI are opening up exciting possibilities…

Designers and jewelers across the globe rely on Castimize to turn their 3D models into real metal objects. Whether you’re creating custom parts, delicate earrings, or meaningful jewelry pieces –…

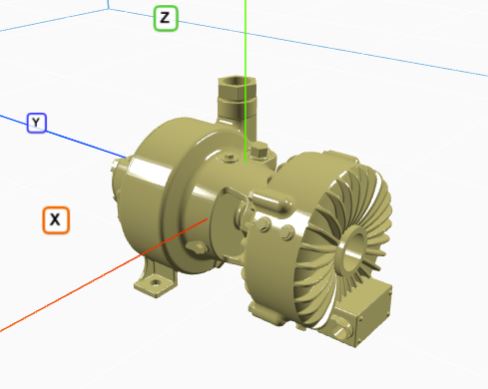

We believe that high-end products deserve high-end craftsmanship. That’s why we’re proud to collaborate with Breggz, the innovative brand behind the Zohn-1, the world’s first fully wireless, custom-made in-ear hearable.…

Introducing Castimize Library: Organize, Save, and Revisit Your Designs Designers know the value of staying organized, and now Castimize makes it easier than ever with our brand-new Library feature! Whether…

The world of 3D design is as exciting as it is rewarding. Have you ever imagined transforming a simple idea into a tangible object, like a beautifully crafted ring or…